By Tyler Ellegard

After years of US stock market dominance, international stocks are staging a comeback in 2025. So far this year, international developed and emerging markets have outperformed their American counterparts, driven by a combination of favorable valuations, improving economic data, and shifting currency dynamics. While U.S. stocks have long been the engine of global equity returns – especially over the past decade – history shows that leadership tends to rotate. There have been multi-year stretches where international markets have outpaced US equities, and this year’s shift raises the question: are we at the start of another such cycle?

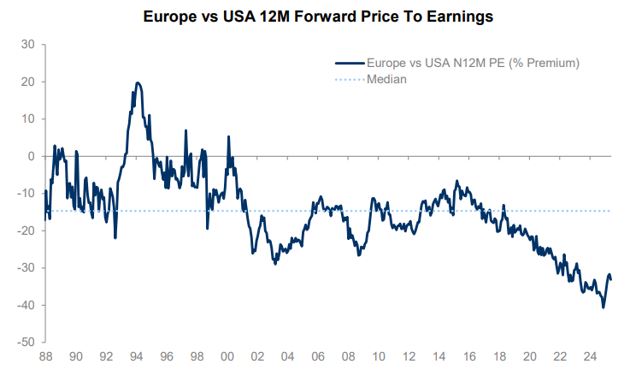

A key driver behind the recent outperformance of international equities is the significant valuation gap between US and non-US markets. US stocks continue to command premium multiples, with the S&P 500 trading at a forward P/E above its historical average, while many international markets remain at a discount relative to both their own history and US benchmarks. The graph below shows the percentage valuation premium/discount for Europe relative to the US markets, which is near a 30% discount.1

Additionally, international countries, specifically the European Union, are considering reforms to fiscal spending rules to potentially allow for more flexibility in spending, particularly on defense and infrastructure. This openness to reform has caught the attention of investors in areas where this newfound flexibility could lead to heightened government investment, which could in turn lead to higher revenues and earnings for corporations.2

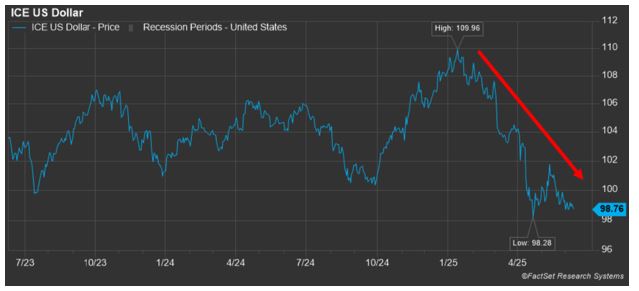

Furthermore, currency dynamics have provided a tailwind for international equities this year. The US Dollar Index – which measures the dollar’s value relative to a basket of major foreign currencies – has declined more than 10% since January 13. The two-year chart below illustrates the broader trend, with particular emphasis on the recent downward move, which has helped boost returns for US-based investors holding foreign assets.

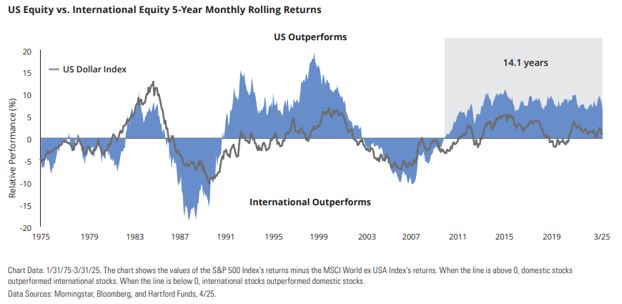

Currency movements, particularly the US dollar, play a meaningful, though not exclusive, role in international investing for U.S.-based investors. The chart below3 highlights the long-term cycles of relative outperformance between US and international equities, with the US Dollar Index overlaid. Historically, periods of sustained dollar weakness have coincided with stronger performance from international markets, while a strengthening dollar has tended to support US outperformance. While currency dynamics are an important factor, they are only part of the story; macroeconomic conditions, political policy shifts, and corporate fundamentals also play critical roles in driving these long-term equity leadership cycles.

While U.S. equities have delivered exceptional returns over the past decade, the current environment suggests a more favorable setup for international markets. With compelling valuations, improving economic momentum abroad, and supportive currency trends, the case for global diversification has strengthened. History shows that leadership between US and international equities tends to shift in cycles, and 2025 may mark the beginning of a new chapter. For investors, maintaining a balanced, globally diversified portfolio may help capture these evolving opportunities while managing long-term risk.

1. Morgan Stanley Research – Strategy Data Gallery 5.30.2025

3. https://www.hartfordfunds.com/dam/en/docs/pub/whitepapers/CCWP014.pdf