By Lisa Schreiber

Coming into 2025, the backdrop seemed perfect for Bitcoin: expectations for multiple interest rate cuts, a more favorable regulatory landscape and growing institutional adoption created strong tailwinds. These factors pushed the largest cryptocurrency to new all-time highs, surpassing $126,000.[1] It was a great year — until it wasn’t. Bitcoin has now wiped out all its gains for the year and officially entered a bear market, defined as a drop of more than 20% from its most recent high. So, what happened?

Up until early October, it had been a strong year for Bitcoin. Its rise above $126,000 came amid a pro-crypto administration with loosening oversight and new legislation supporting the industry. The Genius Act, which was passed in July, established clearer regulations for stablecoin (another kind of cryptocurrency), boosting confidence in the broader cryptocurrency industry. Paul Atkins, a crypto-friendly regulator, took over as the chair of the SEC (Securities and Exchange Commission) and new crypto ETFs made the digital asset more accessible to a wider range of investors.[2]

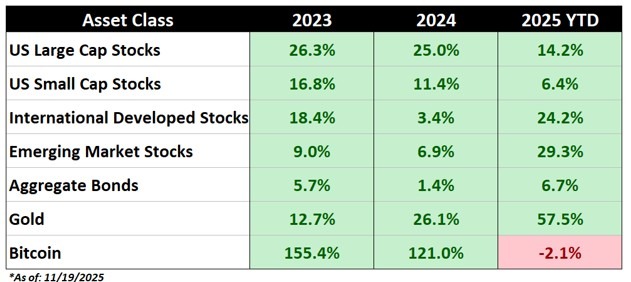

Fast forward to today: Bitcoin has wiped out all of its year-to-date gains, while other asset classes like US stocks, as measured by the S&P 500, are up 14.2% and gold is up 57.5%, as seen in the chart below.[3] The recent decline, which started around Oct. 10, followed mixed signals from the Fed about the timing of interest rate cuts. Higher rates make non-income-paying assets like Bitcoin less attractive, prompting some investors to exit positions. The downturn was also amplified by margin calls, as heavily leveraged positions were liquidated. At the same time, some long-term investors sold their holdings to lock in profits, adding further momentum to the decline.[4]

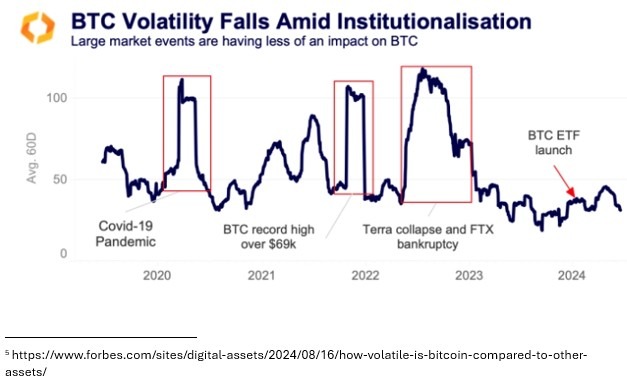

This pullback has renewed concerns about Bitcoin’s volatility, but it’s important to note that volatility is nothing new within this asset class. It reflects the dynamics of supply and demand, investor sentiment, media attention, and regulatory developments. That said, Bitcoin’s volatility has moderated in recent years as institutional adoption has increased, bringing more stability to the market.[5]

Despite the recent negative performance, the underlying factors of the world’s largest cryptocurrency remain intact. Its limited supply creates scarcity that could support higher prices over time. Adoption continues to grow among both retail and institutional investors, potentially reducing volatility further in the future. Bitcoin also offers diversification benefits, as it is less correlated to traditional asset classes like stocks and bonds. Finally, its decentralized and transparent structure — operating without a central authority and verifiable on the blockchain — remains a unique feature compared to traditional assets. [6]

The current environment presents both opportunities and risks. Periods of consolidation can offer attractive entry points for long-term investors who had previously been sidelined by Bitcoin’s outperformance, while regulatory clarity could provide further tailwinds. On the risk side, macro volatility, liquidity gaps, and leveraged outflows remain potential catalysts for sharp price swings. For investors, limiting overall exposure to cryptocurrencies can help reduce downside risk while increasing portfolio diversification.

At Gradient Investments multiple portfolios can offer exposure to Bitcoin. It is currently part of the alternatives sleeve within the Endowment series and also held in the Digital Discovery portfolio.

This endorsement of Gradient Investments, LLC is provided by an investment advisor who refers clients to Gradient Investments, LLC. A conflict of interest exists because this investment advisor receives a portion of the annual management fee charged by Gradient Investments, LLC, based on the assets under management of this investment advisor’s clients. This endorsement could assist in the investment advisor increasing the assets placed with Gradient Investments, LLC, and therefore their compensation. These investment advisors are not affiliated with or supervised by Gradient Investments, LLC.

[1], https://www.cnn.com/2025/11/18/business/bitcoin-price-crypto-stocks

[2] https://www.cnn.com/2025/11/18/business/bitcoin-price-crypto-stocks

[3] FactSet as of 11/19/2025

[4] https://www.morningstar.com/markets/crypto-etf-investors-pull-billions-bitcoin-slides-below-90000

[5] https://www.forbes.com/sites/digital-assets/2024/08/16/how-volatile-is-bitcoin-compared-to-other-assets/

[6] https://www.blackrock.com/us/financial-professionals/insights/bitcoin-unique-diversifier