By Kyle Bergacker

Alternative investments often carry an air of complexity, frequently misunderstood as exotic, overly volatile, or exclusive to the ultra-wealthy. Yet, for clients, these assets offer a compelling opportunity to enhance returns, diversify portfolios, and manage downside risks when approached with the right expertise. Drawing on historical data and market realities, we address five key misconceptions to provide clarity and guide informed decision-making in this evolving space.

1. Alternatives Are Not a New Phenomenon A common view holds that alternative investments are novel and untested. Historical context tells a different story. Hedge funds, for instance, have operated since the 1940s, with significant growth since the 1980s, establishing a robust track record. Beyond hedge funds, alternatives encompass private equity, private debt, real estate, commodities, collectibles, structured product, managed futures, and exchange funds — categories with decades of performance history. Recognizing this longevity underscores the reliability of alternatives as a portfolio component.

2. Risk Is Strategic, Not Reckless The perception that alternatives are inherently high-risk misses the mark. Yes, strategies like leverage, short-selling, and derivatives introduce unique risks, which require thorough due diligence. However, when integrated into a diversified portfolio, alternatives are designed to mitigate volatility and enhance risk-adjusted returns. Data over the past 25 years shows that portfolios with alternative allocations have often delivered higher returns with lower risk compared to traditional long-only strategies. For investors, this balance makes alternatives a powerful tool when paired with proper guidance.

3. Volatility Reduction Through Diversification Some believe alternatives amplify portfolio volatility, but the evidence suggests otherwise. Alternatives typically exhibit low to moderate correlations with stocks and bonds, a dynamic that can stabilize portfolios. Historical analysis highlights that during periods of elevated market turbulence, this low correlation enhances diversification benefits, reducing overall portfolio volatility. For investors looking to hedge against traditional market swings, this characteristic makes alternatives a strategic must have.

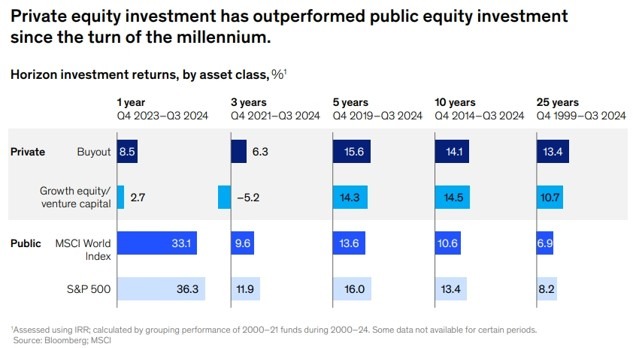

4. Liquidity Varies, with Rewards The notion that all alternatives are illiquid — and thus riskier — oversimplifies the landscape. While certain strategies, like private equity, involve longer lock-up periods, others, such as select equity managers, offer more flexible terms. This spectrum of liquidity is often offset by an “illiquidity premium.” Over the past 25 years, private equity has consistently outperformed public equity, rewarding investors for reduced liquidity. Investors should weigh these trade-offs to align with investment horizons and objectives.

5. Access Is No Longer Exclusive Finally, the idea that alternatives are reserved for institutional investors is outdated. Regulatory shifts have opened these opportunities to qualified retail investors who meet suitability and expertise criteria. This democratization allows investors to incorporate alternatives into their portfolios, broadening access to alternatives diversification and return-enhancing potential.

For investors, alternative investments represent a disciplined approach to navigating today’s complex markets. Historical data and structural trends confirm their value in reducing risk and boosting returns when used thoughtfully.