By Keith Gangl

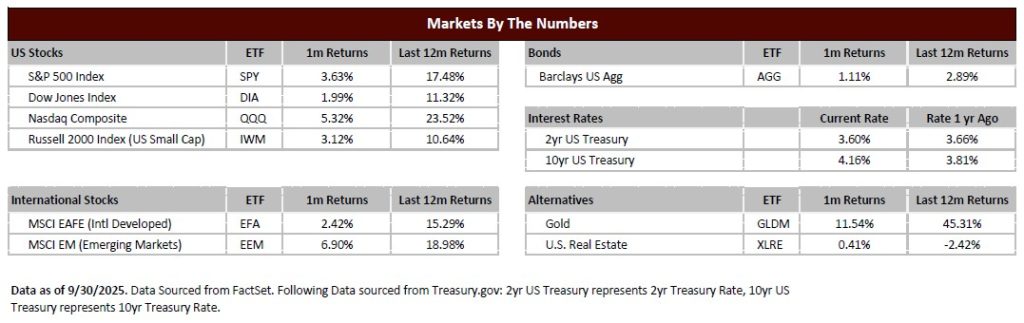

Historically, September has been the worst month of the year for the stock market, as measured by the S&P 500. After a weak start to the month, it appeared history might repeat itself, but investors were in for a pleasant surprise. The markets rallied throughout September, finishing up over 3% for the month, marking the fifth consecutive month of positive returns and defying the seasonal pessimism that typically accompanies this period.

While investors don’t rely solely on historical patterns to make stock selections and allocation decisions, they often use past trends as a guide for what to anticipate. September’s strength caught many off guard, demonstrating once again that markets can deviate from historical norms when fundamental drivers are strong enough.

Despite persistent inflation and a softening job market, investors have focused on a more compelling narrative: robust earnings growth. Current projections point to 10% earnings growth for S&P 500 companies in 2025, with expectations rising following solid second-quarter earnings reports. Even more encouraging, earnings growth for 2026 is forecast to exceed 13%. This sustained earnings momentum has been a key driver propelling the stock market forward, overshadowing near-term economic concerns.

As we enter October, historical patterns suggest we’re moving into the strongest part of the year for equities. However, September’s surprise serves as a reminder that history should be used as a guide, not a rule. Several factors will likely shape market performance in the months ahead.

The government shutdown that began on October 1 raises concerns among investors, who typically dislike uncertainty. However, historical context suggests the impact may be limited. The last 22 government shutdowns since 1976 have averaged only eight days in duration and have not meaningfully affected the economy or stock market. Additionally, furloughed employees typically receive back pay, minimizing the broader economic disruption.

Federal Reserve policy remains another critical variable. In September, the Fed resumed cutting interest rates in response to labor market softening, but policymakers continue monitoring inflation closely. The challenge lies in calibrating the pace of rate cuts, cutting too aggressively could reignite inflation, while cutting too slowly could unnecessarily weaken economic growth. This delicate balancing act will influence both market sentiment and economic conditions in the coming months.

September’s unexpected strength underscores an important investing principle: while historical patterns provide useful context, markets ultimately respond to fundamentals. The combination of strong earnings growth, supportive seasonal trends, and a more accommodative Federal Reserve has created a favorable backdrop for equities, even as inflation and labor market concerns persist.

As we move through the final quarter of 2025, three factors will likely determine how the year ends for equity markets: the duration and resolution of the government shutdown, the Federal Reserve’s policy trajectory and its impact on economic growth, and third quarter earnings results that will either validate or challenge current optimistic projections.

Investors who remain focused on corporate fundamentals rather than headlines, who maintain a long-term perspective, and who remember that surprises, both positive and negative, are an inherent part of market dynamics, will be best positioned to navigate whatever the remainder of 2025 brings. September’s rally reminds us that even in the face of historical headwinds and economic uncertainties, markets can surprise us when the underlying drivers of value remain intact.