By Keith Gangl

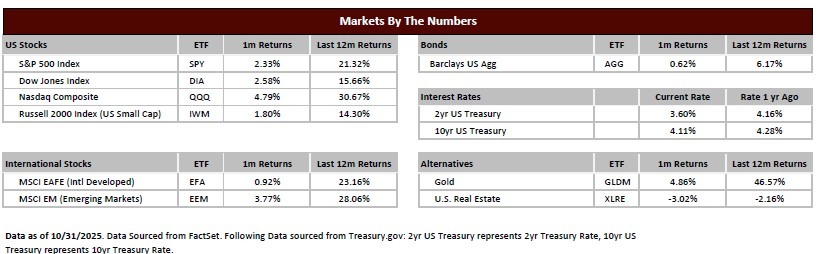

Halloween and October are synonymous with spooky customs and trick-or-treating, just as financial markets are historically known for October volatility. However, this October defied its frightening reputation, delivering treats to investors without any scary surprises or unsettling spikes in market turbulence. The stock market, as measured by the S&P 500, continued its upward trajectory with a gain of over 2% for the month, pushing year-to-date performance over an impressive 16% gain.

Large-cap technology companies have maintained their market leadership throughout 2025, with artificial intelligence remaining the dominant investment theme of the year. October’s quarterly earnings reports from these tech giants exceeded expectations, providing a powerful tailwind for stock prices and reinforcing investor confidence in the AI revolution.

The third quarter earnings season, which begins in October, offered further reasons for optimism. As the month drew to a close, approximately two-thirds of the companies in the S&P 500 reported their earnings with a majority surpassing consensus expectations, a key driver behind the market’s positive performance. Since company earnings growth is a component of stock price movements, these robust results suggest potential continued momentum. However, the remaining third of earnings reports will be crucial in determining whether this upbeat outlook can be sustained.

While October delivered sweet returns, one notable source of concern emerged: a government shutdown that commenced on October 1 and remained unresolved as the month ended. The longer this impasse extends into November, the greater the uncertainty it creates, and investors don’t like uncertainty, which could cause a pause in the market performance. We will be closely monitoring whether this shutdown begins to cause measurable economic disruption that could dampen investor sentiment.

As we move into November and December, markets typically enter their seasonally strongest period of the year. The combination of solid earnings growth, AI-driven innovation, and historical seasonal patterns suggests a favorable backdrop for continued gains. However, the unresolved government shutdown serves as a reminder that even in the sweetest of market environments, risks lurk in the shadows. Investors would be wise to remain vigilant, monitoring both the resolution of political gridlock and the completion of earnings season, while maintaining a balanced perspective. After all, successful investing requires appreciating the treats while staying alert for potential tricks that may lie ahead.

This endorsement of Gradient Investments, LLC is provided by an investment advisor who refers clients to Gradient Investments, LLC. A conflict of interest exists because this investment advisor receives a portion of the annual management fee charged by Gradient Investments, LLC, based on the assets under management of this investment advisor’s clients. This endorsement could assist in the investment advisor increasing the assets placed with Gradient Investments, LLC, and therefore their compensation. These investment advisors are not affiliated with or supervised by Gradient Investments, LLC.