By Keith Gangl

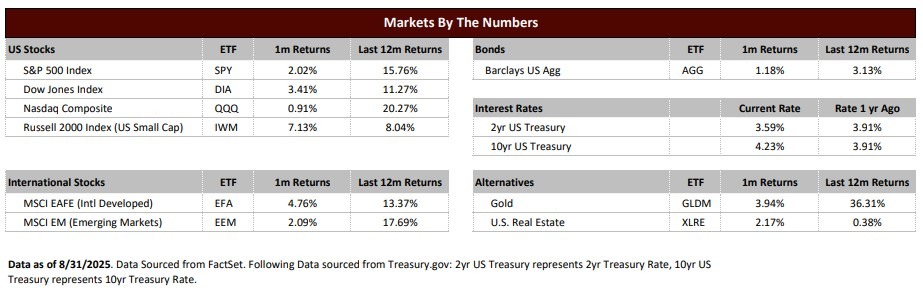

The US stock market finished in positive territory in August, with the S&P 500 posting a 2.02% gain to extend its winning streak to four consecutive months. This resilience came despite a challenging backdrop of economic uncertainty, evolving tariff policies, and persistent trade tensions. One of the catalysts for August’s positive performance was growing investor confidence that the Federal Reserve would pivot toward rate cuts in September.

President Trump’s strategic use of tariffs as a negotiating tool has created a new paradigm that markets are increasingly embracing rather than fearing. The transformation in investor sentiment has been remarkable: where April’s initial tariff announcements triggered sharp selloffs amid fears of economic disruption, recent earnings reports suggest minimal actual impact on corporate performance.

Second quarter earnings provided the first meaningful data on tariff effects, revealing that companies have largely managed to navigate the new trade landscape effectively. While the policy environment remains fluid and tariffs continue to evolve, the initial corporate response indicates greater adaptability than many anticipated.

August marked a notable shift in market focus from trade policy concerns back to monetary policy expectations. Investors began parsing Federal Reserve communications with renewed intensity as economic data suggested potential cracks in the labor market foundation.

The Fed operates under a dual mandate: maintaining maximum employment while ensuring price stability through a target inflation rate of 2%. After inflation peaked at over 9% in June 2022, the measure has steadily declined toward the Fed’s target, recently hovering around 2.5%.

However, employment data delivered a concerning signal in August. Job creation figures for the previous two months were revised downward by more than 200,000 positions, creating immediate market anxiety about labor market strength. This revision suggested that employment growth might be cooling faster than previously understood.

Federal Reserve Chairman Jerome Powell used the Jackson Hole Economic Symposium as a platform to telegraph potential policy changes, explicitly citing labor market softening as justification for considering rate cuts at the September meeting. This marked a significant shift from the Fed’s previous hawkish stance.

The September 5 non-farm payrolls and unemployment report now carries heightened significance as the next critical data point. A disappointing jobs report would likely cement expectations for Federal Reserve rate cuts, while stronger-than-expected numbers could delay monetary policy easing.

As we move into September, the markets find themselves at a critical juncture where tariff resilience meets monetary policy expectations. The S&P 500’s four-month winning streak reflects not just investor optimism, but a maturing market that has learned to navigate the complexities of modern economic policy. With the Federal Reserve poised to potentially reverse course on interest rates and companies demonstrating their ability to weather trade policy storms, the stage is set for what could be an important period for both market sentiment and economic fundamentals.

In this environment of shifting policies and evolving economic conditions, the importance of maintaining a diversified investment portfolio becomes even more pronounced, as different asset classes and sectors may respond differently to Fed rate cuts and ongoing trade developments. While uncertainty remains the only constant in this environment, the market’s ability to climb higher amid such varied challenges suggests an underlying strength that may well carry through the remainder of the year and into next year — but expect bumps along the way.